Business Insurance in and around Calera

Searching for protection for your business? Search no further than State Farm agent Jami Noe!

No funny business here

This Coverage Is Worth It.

You may be feeling like there is so much to do with running your small business and that you have to handle it all by yourself. State Farm agent Jami Noe, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

Searching for protection for your business? Search no further than State Farm agent Jami Noe!

No funny business here

Surprisingly Great Insurance

Whether you are a plumber a photographer, or you own a dance school, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Jami Noe can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and equipment breakdown.

It's time to reach out to State Farm agent Jami Noe. You'll quickly observe why State Farm is the reliable name for small business insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

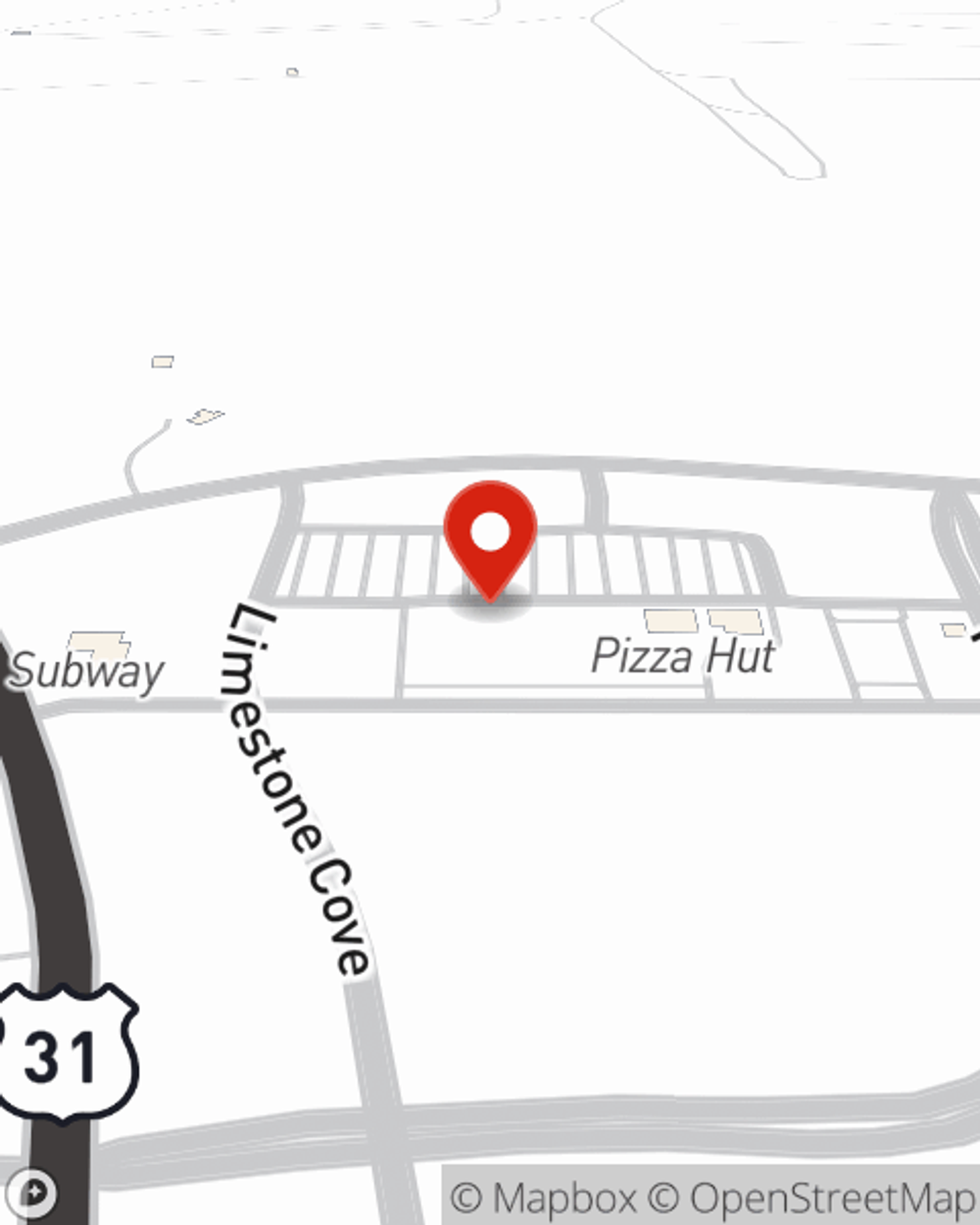

Jami Noe

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.